CORPORATE GOVERNANACE

SimiGon’s Board of Directors is committed to maintaining high standards of corporate governance and adheres to the Quoted Companies Alliance’s (QCA) Corporate Governance Code for small and mid-size quoted companies (the “Code”).

Changes to AIM rules on 30 March 2018 require AIM companies to comply or explain against a recognised corporate governance code by 28 September 2018. The Code was revised in April 2018 and sets out ten broad principles of corporate governance, states what are considered to be appropriate corporate governance arrangements for growing companies and requires companies to provide an explanation about how they are meeting the principles through certain prescribed disclosures.

The Chairman leads the Board and is responsible for its overall effectiveness in directing the Company. He manages together with the Company’s CEO & CFO the Board agenda and ensures that all Directors receive accurate, timely and clear information and effectively contribute their various talents and experience in the development and implementation of the Company’s strategy. He ensures that the nature and extent of the significant risks the Company is willing to embrace in the implementation of its strategy are challenged and determined by the Board. The Chairman is responsible for ensuring that the Board implements, maintains and communicates effective corporate governance processes and for promoting a culture of openness and debate designed to foster a positive governance culture throughout the Company.

The Board has considered how each principle is applied and provides below an explanation of the approach taken in relation to each and how they support the Company’s medium to long-term success.

The Board considers that it does not depart from any of the principles of the QCA Code.

PRINCIPLE 1: ESTABLISH A STRATEGY AND BUSINESS MODEL WHICH PROMOTE LONG-TERM VALUE FOR SHAREHOLDERS

SimiGon's Virtual Learning platform ("SIMbox") allows organisations to train their people more efficiently and reduce risk to their companies. Our business model is to established direct customer relationships, receive a greater share of revenue & profit on each contract and to increase opportunities to win further contracts, extensions or maintenance agreements with existing customers. Our strategy is to:

Use SimiGon’s established position as a prime contractor and high quality operator to target significantly larger contracts

Leverage extensive long term partnerships to expand agreements and gain further new contracts

Continue to cement position as the preferred supplier of training and simulation technologies for the world’s largest military flight training programs

Build on diversification into other domains

Build on diversification into other fast growing sectors outside aerospace and defence such as civil aviation, crane operators and the oil & gas markets

Continue global expansion into other high growth regions

As SimiGon continues to grow it will increase and enhance its workforce to ensure the high quality and delivery targets demanded by customers are maintained

The key challenges we face include:

Competition - Although the Directors believe that SimiGon has no direct competitors, it is the case that other companies have capabilities in simulation software. These include game designers, simulator manufacturers and major defence contractors.

Continued product development and introduction - The development of new or enhanced products is a complex process and delays may be experienced due to difficulties encountered in the design and manufacturing processes, which could prevent or delay the introduction of new or enhanced products. The Company continually develop and refine its products in order to maintain (or increase) its market position.

Expansion into new markets – Having no guarantee that entry into new markets will generate commercially viable, SimiGon puts its focus on expanding its capabilities to provide training simulation for additional fast growing domains outside aerospace and defence such as civil aviation, crane operators and the oil & gas markets.

Recruiting and retaining suitable staff – To be able execute its strategy, SimiGon’s ability is dependent on the skills and abilities of its staff. SimiGon undertake ongoing initiatives to foster good staff engagement and ensure that remuneration packages are competitive in the market.

We believe we have the right strategy and service in place to address our key challenges and to deliver strong growth in sales over the long term.

PRINCIPLE 2: SEEK TO UNDERSTAND AND MEET SHAREHOLDER NEEDS AND EXPECTATIONS

The Group seeks to maintain and enhance good relations with its shareholders. The Company’s interim and annual reports are supplemented by capital market presentations and through public announcements to the market on technological, commercial and financial progress.

The Chief Executive Officer and the Chief Financial Officer are primarily responsible for maintaining dialogue with shareholders, supported by the Company’s broker. The CEO and CFO hold both one-to-one and group meetings with shareholders and the investing community following the announcement of the annual and interim results. The Chairman also attends a number of these group meetings. Following these meetings, the Company’s brokers provide independent and anonymised feedback to the Board on shareholders’ views.

During the last 55 months under review (the Period) the following activities were pursued to develop a good understanding of the needs and expectations of all constituents of SimiGon’s shareholder base:

Date

17-Apr

17-Jun

17-Sep

18-Apr

18-Sep

18-Dec

19-Apr

19-Sep

19-Dec

20-April

20-April

20-Sep

20-Dec

21-April

21-Sep

21-December

18-February

Description

Preliminary results roadshow

Interim results roadshow

AGM

Preliminary results roadshow

Interim results

AGM

Preliminary results

Interim results

AGM

General Meeting

Full year results

Interim Results

AGM

Full year results

Interim Results

AGM

Special General Meeting

Participants

Current and potential shareholders

Current and potential shareholders

Current shareholders

Current and potential shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

Current shareholders

SimiGon is committed to communicating openly with its shareholders to ensure that its strategy and performance are clearly understood. SimiGon communicates with shareholders through the Annual Report and Accounts, full-year and half-year announcements, trading updates and the annual general meeting (AGM), and SimiGon encourages shareholders’ participation in face-to-face meetings. A range of corporate information is also available to shareholders, investors and the public on our website.

The AGM is the principal forum for dialogue with private shareholders, and we encourage all shareholders to attend and participate. The Notice of Meeting is sent to shareholders at least 35 days before the meeting. The chairs of the board and all committees, together with all other directors whenever possible, attend the AGM and are available to answer questions raised by shareholders. Shareholders vote on each resolution, by way of a poll. For each resolution we announce the number of votes received for, against and withheld and subsequently publish them on our website.

PRINCIPLE 3: TAKE INTO ACCOUNT WIDER STAKEHOLDER AND SOCIAL RESPONSIBILITIES AND THEIR IMPLICATIONS FOR LONG-TERM SUCCESS

Staff

Our ability to fulfill client services and develop and enhance the software platforms on which they depend relies on having talented and motivated staff. Good two-way communication with staff is a key requirement for high levels of engagement, fostering a culture of innovation. Specific actions include:

Good two-way communication with staff is a key requirement for high levels of engagement, fostering a culture of innovation.

Effective communication is essential to ensure its employees are fully engaged with the business. The senior management team meets regularly to discuss business progress and interdepartmental issues and line managers update employees on Company progress and objectives.

Employees have annual appraisals to set objectives, identify strengths and areas for development.

Training is provided where necessary to enhance job performance and aid development.

The Company regularly reviews the benefits offered to employees.

Clients

Our success and competitive advantage are dependent upon fulfilling client requirements, particularly in relation to quality of service, its speed of delivery and security. Understanding current and emerging requirements of clients enables us to develop new and enhanced services, together with software to support the fulfillment of those services.

Specific actions include:

Seek feedback on services and software systems.

Obtain fulfillment metrics employed by clients to measure performance.

Obtain requests for new services and service enhancements.

Shareholders

As a public company we must provide transparent, easy-to-understand and balanced information to ensure support and confidence. Meeting regulatory requirements and understanding shareholder sentiments on the business, its prospects and performance of management.

Specific actions include:

Regulatory news releases.

Keeping the investor relations section of the website up to date.

Periodic investor newsletters.

Participation at investor events.

Preforming media interviews.

Annual and half-year reports and presentations.

Annual General Meeting.

Industry bodies

The services we provide must meet certain requirements. The views of certain industry groups, including the National Defense Industrial Association (NDIA) and National Training and Simulation Association (NTSA) are influential in the way the Company is perceived by certain clients.

Specific actions include:

Membership of NDIA and NTSA and participation in security programs.

Annual audit of security.

PRINCIPLE 5: MAINTAIN THE BOARD AS A WELL-FUNCTIONING, BALANCED TEAM LED BY THE CHAIR

The board consists of five directors of which two executive Directors, one Non- Executive Directors and two independent Non-Executive Directors, with a gender balance of 80% male and 20% female.

The directors are required to attend all committee meetings and to be available at other times as required for face-to-face and telephone meetings with the executive team and investors.

The members of the board have a collective responsibility and legal obligation to promote the interests of the Company, and are collectively responsible for defining corporate governance arrangements.

The Chairman is responsible for the effective leadership, operation and governance of the Board and its Committees. He ensures that Directors contribute effectively in the development and implementation of the Company’s strategy whilst ensuring that the nature and extent of the significant risks the Company is willing to embrace in the implementation of its strategy are determined and challenged. The Chief Executive Officer is responsible for the management of the Group’s business and for implementing the Group’s strategy

Each of the Non-Executive Directors is considered independent of management and free of any relationship that could materially interfere with the exercise of their independent judgement. The Chairman was considered independent upon his appointment.

The board is supported by two committees: audit and remuneration. The board does not consider that it is of a size at present to require a separate nominations committee, and all members of the board are involved in the appointment of new directors.

Non-executive directors are required to attend all board and board committee meetings and to be available at other times as required for face-to-face and telephone meetings with the executive team and investors.

Meetings held during the Period and the attendance of directors is summarized below:

Board

Meetings

Board Audit

Meeting Committee

Remuneration

Committee

Executive directors

Amos Vizer

Efraim Manea

Non-executive directors

Alistair Rae ***)

Simon Bentley ***)

Eitan Cohen *)

Omer C. Eyal **)

Ran Pappo

Deborah M. Bitman ****)

Ronit Schwartz ****)

Scheduled Attended Scheduled Attended Scheduled Attended

30 30 - - - -

30 30 - - - -

19 18 - - 3 3

18 18 6 6 1 1

4 3 3 2 - -

6 6 3 3 - -

20 20 13 13 3 3

9 9 7 7 2 2

20 20 6 6 1 1

*) Till December 13, 2017.

**) Commencing April 17, 2018 till December 2019.

***) Mr Rae has been replaced by Simon Bentley on August 1st, 2019.

****) Mrs. Deborah M. Bitman was replaced by Mrs. Ronit Schwarts.

The board has a schedule of regular business, financial and operational matters, and each board committee has compiled a schedule of work to ensure that all areas for which the board has responsibility are addressed and reviewed during the course of the year. The chairman is responsible for ensuring that, to inform decision-making, directors receive accurate, sufficient and timely information. The company secretary compiles the board and committee papers which are circulated to directors prior to meetings. The company secretary provides minutes of each meeting and every director is aware of the right to have any concerns minutes and to seek independent advice at the Company’s expense where appropriate.

PRINCIPLE 6: ENSURE THAT BETWEEN THEM THE DIRECTORS HAVE THE NECESSARY UP-TO-DATE EXPERIENCE, SKILLS AND CAPABILITIES

All five members of the board bring relevant business and knowledge experience and two members are chartered accountants. One director is female and four are male. The board believes that its blend of relevant experience, skills and personal qualities and capabilities is sufficient to enable it to successfully execute its strategy. The directors will continue to monitor both the boards mix of skill, experience and gender balance on the board to assure that it is well positioned to help develop and grow the business going forward.

Amos (Ami) Vizer, Executive Chairman & CEO

Term of office: Mr. Amos Vizer is a co-founder from SimiGon’s inception and has been the CEO an executive director of the Company since 4 November 1998.Background and suitability for the role: Prior to founding SimiGon, Amos founded LogiCali, a software development house specializing in data storage applications. He previously served as marketing and business development manager of ISYS Operational Management Systems, an international IT company. Amos also previously worked for the missiles division of RAFAEL Armament Development Authority Ltd. Additionally, he served ten years in the Israeli Air Force (IAF) as an F-4 Phantom Fighter navigator, a flight school course commander, and a Popeye missile weapons officer. With extensive training in advanced software development, Amos holds a BA in business administration.

Efraim Manea, CFO, Director and Company Secretary

Term of office: Mr. Efraim Manea was appointed as an executive director on July 30, 2010.

Background and suitability for the role: Mr. Manea joined the Company as its finance controller in June 2008, managing its financial aspects including financial reporting, corporation accounting and tax preparation, budget and forecasting and risk management. Mr. Manea also fulfils the role of Company Secretary. He has more than fifteen years of accounting and management experience and before joining SimiGon served for approximately four years as an Audit Team Manager at Ernst & Young's High-Technology sector. Mr Manea is a Certified Public Accountant and holds a BA in Accounting and Business Administration from the College for Management in Israel.

Simon Bentley, Senior Independent Non-Executive Director

Term of office: Mr. Bentley was appointed as non-executive director and serves as Senior Independent non-executive director on August 1, 2019. Member of the Audit Committee and the Remuneration Committee.

Mr Bentley is currently Executive Chairman of Dominion ATM Banking Systems Ltd, trading as Cash on the Move, a UK mobile cash operator and a Non-Executive Director of Premier Foods plc. Among previous appointments, Mr Bentley was Chairman and Chief Executive of Blacks Leisure Group plc from 1987 to 2002, Deputy Chairman of law firm Mishcon de Reya from 2002 to 2009 and Senior Independent Non-Executive Director of Sports Direct International plc from 2007 to 2018. Mr Bentley is a certified FCA, having previously been a senior partner at Landau Morley LLP.

Mr. Ran Pappo, Independent Non-Executive Director

Term of office: Mr. Ran Pappo Joined as Independent Non-Executive Director on December 30, 2015; Chair of the Audit Committee and member of the Remuneration Committee.

Background and suitability for the role: Ran Pappo has 25 years of business experience while delivering results worldwide. Mr. Pappo is the Chief Executive Officer of Diva Hirschthal Ltd. a large organization engaged in designing, manufacturing and world wild selling of high quality swimwear. Mr. Pappo also serves as a director in JS Group Srl, supervising its financial activities while reviewing its manuals and goals. Mr Pappo is a strategic consultant focusing on organizational workflows, financial forecasting, budgeting, auditing, human resources optimization, production planning and marketing. Mr. Pappo has an extensive financial knowledge including budgeting, managing and auditing financial statements for national Organizations. Mr. Pappo holds a BS in Business Administration, Finance and International Marketing, from the College for Management in Israel.

Ronit Schwartz, Independent Non-Executive Director

Term of office: Mrs. Schwartz, appointed (subject to shareholders approval) as an independent director on August 30, 2019. Member of the Audit Committee and the Remuneration Committee.

Mrs. Schwartz has considerable experience at board level of government and publicly-traded companies, and has held a wide variety of executive and non-executive roles during the course of her career. Mrs. Schwartz is currently a director at Petroleum & Energy Infrastructures, Ltd., Elad Canada and Amir Agricultural Investments, Ltd. Mrs. Schwartz has 21 years' experience in banking part of them as a financial executive and deputy director, skilled in finance, credit risk, foreign currency trading, budgeting and corporate governance. Mrs. Schwartz holds a BA in Economics and MBA in Marketing and Finance from Tel Aviv University.Mrs. Schwartz has considerable experience at board level of government and publicly-traded companies, and has held a wide variety of executive and non-executive roles during the course of her career. Mrs. Schwartz is currently a director at Petroleum & Energy Infrastructures, Ltd., Elad Canada and Amir Agricultural Investments, Ltd. Mrs. Schwartz has 21 years' experience in banking part of them as a financial executive and deputy director, skilled in finance, credit risk, foreign currency trading, budgeting and corporate governance. Mrs. Schwartz holds a BA in Economics and MBA in Marketing and Finance from Tel Aviv University.

PRINCIPLE 7: EVALUATE BOARD PERFORMANCE BASED ON CLEAR AND RELEVANT OBJECTIVES, SEEKING CONTINUOUS IMPROVEMENT

A board evaluation process led by the chairman was initiated alongside the Company’s adoption of the QCA code and will form an important part of the ongoing review process. All current directors completed questionnaires about the effectiveness of the board and a self-assessment if their own contributions which were assessed and reviewed by the chairman. These questionnaires form the basis for a one-on-one discussion with directors about their current and future performance, which in turn was collectively summarized with the board as a whole.

The review considers effectiveness in a number of areas including general supervision and oversight, business risks and trends, succession and related matters, communications, ethics and compliance, corporate governance and individual contribution.

We will be considering the use of external facilitators in future board evaluations.

As the business expands, the executive directors will be challenged to identify potential internal candidates who could potentially occupy board positions, and set out development plans for these individuals.

As is common with many small companies, the Company does not have internal candidates to succeed existing Directors. This will be kept under review, especially when recruiting for senior roles as vacancies arise. However, the Board did not believe it is appropriate to recruit additional Directors or senior personnel solely for the purpose of succession planning.

Principle 8: Promote a corporate culture that is based on ethical values and behaviors

SimiGon’s products are used by blue cheap clients around the world. The Company’s good reputation is key to continuing to grow its business in existing markets and penetrate new markets.

Our long-term growth is underpinned by the following core values:

Customers - We place our customers first, putting ourselves in their shoes to understand the current and future needs of those who use our products and services, and always striving to exceed their expectations.

Technology innovation - We are committed to innovation in what we do and how we do it, and to working smarter rather than harder to reduce costs, increase efficiency and make learning easier by being creative, pragmatic and different.

Motivation - We have an enduring positive attitude that stems from being self-motivated, adaptable and agile and feeling fully empowered to make a difference, speaking out with ideas and suggestions to make things better.

Working philosophy - We respect one another and are courteous, honest and straightforward in all our dealings, we honor diversity, individuality and personal differences, and are committed to conducting our business with the highest personal, professional and ethical standards.

The culture of the Company is characterized by these values which are communicated regularly to staff through internal communications and forums. A staff recognition programme operates on an ongoing basis by employees are recognized for contributions that is in keeping with the core values and their efforts goes above and beyond the norm.

The board believes that a culture that is based on the core values is a competitive advantage and consistent with fulfillment of the Company’s mission and execution of its strategy.

PRINCIPLE 9: MAINTAIN GOVERNANCE STRUCTURES AND PROCESSES THAT ARE FIT FOR PURPOSE AND SUPPORT GOOD DECISION-MAKING BY THE BOARD

The Board comprises two executive Directors, one Non- Executive Directors and two independent Non-Executive Directors nominated by the majority shareholders of the Company. The Board generally meets a minimum five times a year and receives a Board pack comprising a report from senior management together with any other material deemed necessary for the Board to discharge its duties. It is the Board’s responsibility for formulating, reviewing and approving SimiGon’s strategy, budgets, major items of expenditure and acquisitions.

The Board is responsible for the system of internal control and for reviewing its effectiveness. Such systems are designed to manage rather than eliminate risks and can provide only reasonable and not absolute assurance against material misstatement or loss. Each year, on behalf of the Board, the audit committee reviews the effectiveness of these systems. This is achieved primarily by considering risks potentially affecting the Company and from discussions with the external auditors. Each year, the Company is subject to internal audit, the results of which are presented to the audit committee.

A comprehensive budgeting process is completed once a year and is reviewed and approved by the Board. SimiGon’s results, as compared against budget, are reported to the Board on a quarterly basis and discussed in detail at each meeting of the Board. The Company maintains appropriate insurance cover in respect of any legal actions against the Directors as well as against material loss or claims against the Company and reviews the adequacy of the cover regularly. To comply with AIM rules, the Company has adopted a code for dealings in its shares by directors and employees.

The audit committee meets at least twice a year. The role of the audit committee is to review the management and systems of internal control of the company, including in consultation with the internal auditor and the company’s independent auditor and to recommend any remedial action. In addition, the approval of the audit committee is required to effect certain related-party transactions. In addition, the approval of the audit committee is required to effect certain related-party transactions.

The remuneration committee has a primary responsibility to review the performance of the Company’s executive directors and the senior employees and to recommend their remuneration and other terms of employment.

The Chairman has overall responsibility for corporate governance and in promoting high standards throughout the Company. He leads and chairs the board, ensuring that committees are properly structured and operate with appropriate terms of reference, ensures that performance of individual directors, the board and its committees are reviewed on a regular basis, leads in the development of strategy and setting objectives, and oversees communication between the Company and its shareholders.

The CEO provides coherent leadership and management of the Company, leads the development of objectives, strategies and performance standards as agreed by the board, monitors, reviews and manages key risks and strategies with the board, ensures that the assets of the Company are maintained and safeguarded, leads on investor relations activities to ensure communications and the Company’s standing with shareholders and financial institutions is maintained, and ensures that the board is aware of the views and opinions of employees on relevant matters.

The Independent Non-Executive Directors contribute independent thinking and judgement through the application of their external experience and knowledge, scrutinize the performance of management, provide constructive challenge to the executive directors and ensure that the Company is operating within the governance and risk framework approved by the board.

The Company Secretary is responsible for providing clear and timely information flow to the board and its committees and supports the board on matters of corporate governance and risk.

The matters reserved for the board are:

Setting long-term objectives and commercial strategy.

Approving annual operating and capital expenditure budgets.

Changing the share capital or corporate structure of the Company.

Approving half-year and full-year results and reports.

Approving dividend policy and the declaration of dividends.

Approving major investments, disposals, capital projects or contracts.

Approving resolutions to be put to general meetings of shareholders and the associated documents or circulars.

Approving changes to the board structure.

The board has approved the adoption of the QCA Code as its governance framework against which this statement has been prepared and will monitor the suitability of this code on an annual basis and revise its governance framework as appropriate as the group evolves.

Principle 10: Communicate how the company is governed and is performing by maintaining a dialogue with shareholders and other relevant stakeholders

In addition to the investor relations activities described above, the following, Group’s Annual General Meeting, Audit and Remuneration committee reports are provided.

All shareholders are invited to make use of the Group’s Annual General Meeting (AGM) to raise any questions regarding the management or performance of the Company.

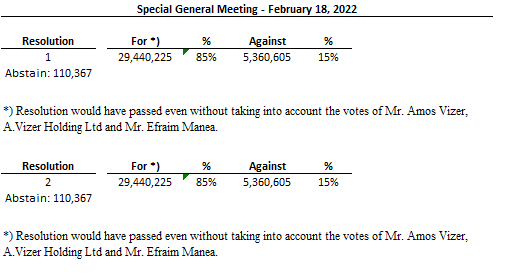

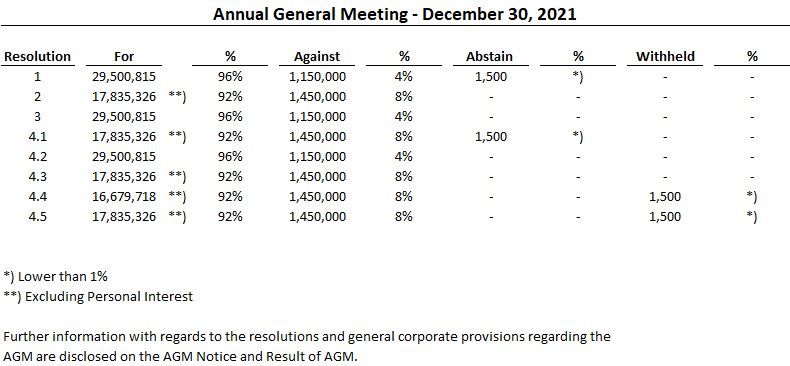

Votes:

Shareholder votes and meetings from the preceding 24 months:

Annual General Meeting - December 30, 2020

Resolution For % Against % Withheld %

1 21,675,590 100 - - 1,500 *)

2 21,675,590 100 - - 1,500 *)

*) Lower thank 1%

Further information with regards to the resolutions and general corporate provisions regarding the

AGM are disclosed on the AGM Notice

General Meeting - April 16, 2020

Resolution For % Against % Withheld %

1 29,756,795 90 3,292,843 10 1,500 *)

2 31,421,795 95 1,627,843 5 - -

3 29,756,795 90 3,292,843 10 - -

4 29,554,875 90 3,444,763 10 - -

4 16,496,038 **) 83 **) 3,444,763 17 **) - -

5 29,706,795 90 3,292,843 10 - -

5 18,341,306 **) 85 **) 3,292,843 15 **) - -

*) Lower thank 1%

**) Excluding Personal Interest

Further information with regards to the resolutions and general corporate provisions regarding the AGM are disclosed on the AGM Notice.

Annual General Meeting - December 30, 2019

Resolution For % Against % Withheld %

1 18,258,488 92 - - 1,501,500 8

2 18,258,488 92 1,500,000 8 1,500 *)

3 18,258,488 92 1,500,000 8 1,500 *)

*) Lower than 1%

Further information with regards to the resolutions and general corporate provisions regarding the AGM are disclosed on the AGM Notice.

Audit Committee Report

The Audit Committee consists of Mr. Simon Bentley, Mr. Ran Pappo and Mrs. Ronit Schwarts. During the period, the Audit Committee has continued to focus on the effectiveness of the controls throughout the Company.

The committee met (the Chairman of the Board, CEO and CFO were invited to attend these meetings) and consideration was given to the internal auditor’s report over the accounting system.

Remuneration Committee Report

The remit of the Remuneration Committee review the performance of the executive directors and make recommendations to the Board on matters relating to their remuneration and terms of employment. The committee will also make recommendations to the Board on proposals for the granting of share options and other equity incentives pursuant to any share option scheme or equity incentive scheme in operation from time to time. The Remuneration Committee consists of Mr. Ran Pappo and Mr. Ronit Schwarts. The committee met 3 times during the Period to approve the conversion of 2016 annual cash bonus into ordinary shares of the Company, to approve Mr. Omer C. Eyal compensation as a non-executive director of SimiGon, to approve Mr. Efraim Manea (CFO and executive director) and Mr. Alon Shavit (EVP, Business Development) compensation and to re-approve the Company's Compensation Policy Plan for Officers and Directors.